FinAI Network: Web2 Enterprise Payment Settlement Expansion Collaboration

Building Trust Infrastructure for the Machine Economy

Version 2.3 | Last Updated: December 2025 | Status: Ecosystem Collaboration Proposal

"Every AI Agent is a verifiable economic entity——possessing identity, payment, and reputation."

"Trust will become a first-class citizen in the machine economy."

Table of Contents

📋 Document Structure

- Introduction: FinAI Network Overview

- Collaboration Framework: Ecosystem Development Strategy

- Web2 Enterprise Payment Settlement Expansion Collaboration

- Collaboration Process and Contact Information

- Implementation Path: From Collaboration to Launch

- Business Collaboration: Contact and Support

1. Introduction: FinAI Network Overview

🎯 Mission and Vision

Mission: Empower every AI Agent to become a verifiable economic entity, possessing identity, autonomous payment, and reputation within an open, trusted, and self-sustaining Agent economic layer.

Vision: Establish the global trust infrastructure for autonomous AI economies, enabling every intelligent proxy to securely earn, pay, and build trust.

📈 FinAI Product Scenarios

to AI Agent: User AI Agent + NFT

- Early registration of various personality NFTs to provide personalized AI Agent experiences for users

- Subsequent NFT-empowered AI Agents to support various innovative gameplay and economic models

to B: Three Core Capabilities

- Blockchain payment settlement capability: Secure and efficient on-chain payment infrastructure

- On-chain reputation mechanism: ERC-8004 identity and reputation system, establishing trust foundation

- AI Agent economic hub: Standardized protocols connecting various economic participants

🏗️ Core Value Architecture

FinAI Network provides five parallel foundational capabilities for the AI Agent economy:

- Blockchain Payment Capability: x402 protocol, enabling secure and efficient on-chain payments and settlements

- AI Agent Usage Access Capability: RESTful APIs, supporting convenient calls and integration of AI Agents

- AI Agent Economic Access: Standardized protocols, helping all parties seamlessly access the AI Agent ecosystem

- On-chain Reputation Mechanism: ERC-8004 identity and reputation system, establishing trust foundation

- Bank-grade Security: Financial institution-level security standards and compliance, ensuring the highest trust and protection for financial transactions

Core Advantages: Five-in-one capabilities provide complete technical infrastructure for the AI Agent economy.

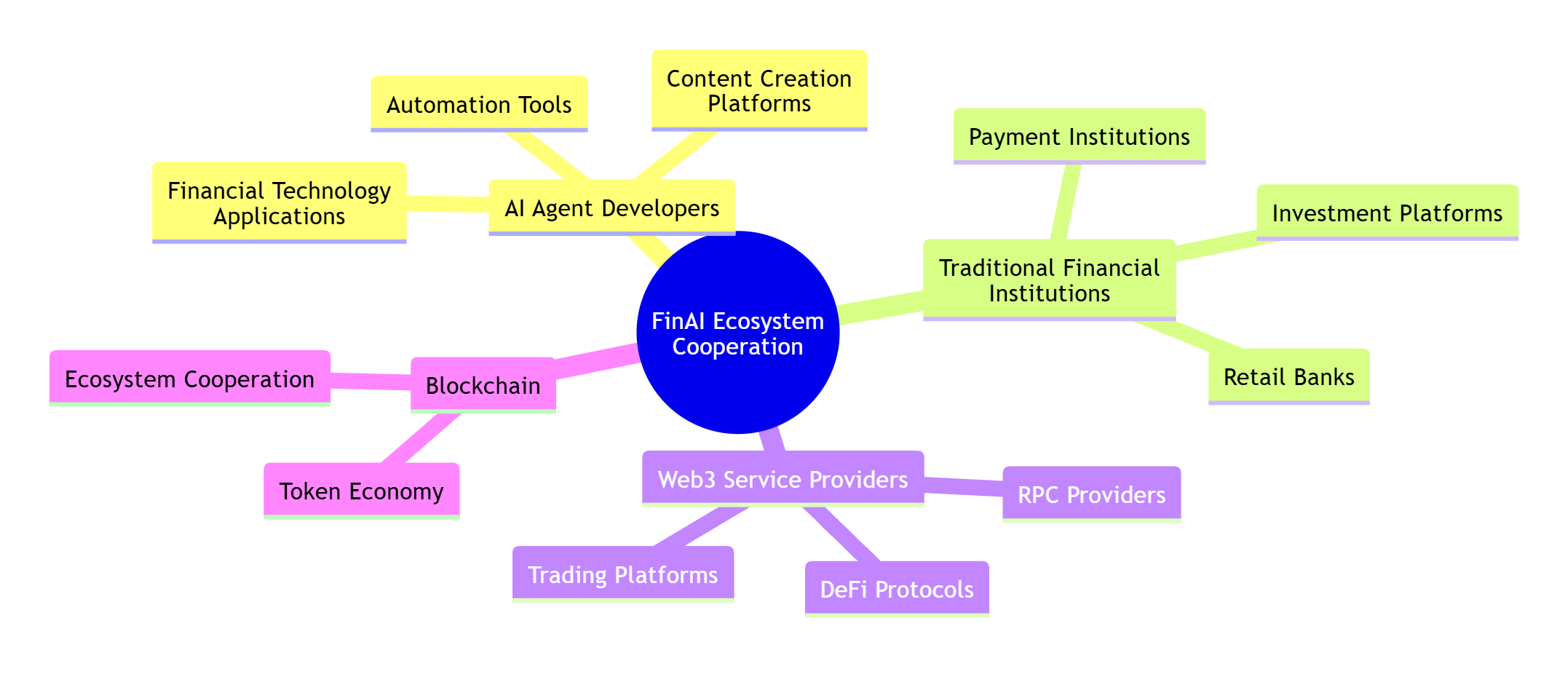

🎯 Three Major Business Scenario Expansions

1. Expansion of Web2 Enterprise Payment Settlements

- Traditional bank digital transformation to obtain on-chain payment capabilities

- Cross-border e-commerce payment optimization, reducing costs and improving efficiency

- Innovative AI large model payment modes, supporting pay-as-you-go

- AI Agent usage payment modes, establishing new economic payment systems

2. Web3 Service Provider Cooperation Expansion

- Cooperation with exchanges to integrate AI Agent trading capabilities

- DeFi project access, providing smart contract payment support

- Blockchain project expansion, adding AI Agent economic scenarios

3. Blockchain Platform Strategic Cooperation

- Mainstream chain integration, expanding payment and identity capabilities

- Autonomous chain construction, creating AI Agent-exclusive economic environments

- Token economy innovation, combining AI Agent to create value

- Cross-chain AI Agent economy, building multi-chain collaborative ecosystems

Why Choose FinAI?

✅ Zero Threshold Integration: Simple APIs, no blockchain knowledge required ✅ One-Click Payment: EIP-2612 / 3009 signature technology ✅ Zero GAS Fees: We bear all transaction fees ✅ Chain-native Security: Cryptographic security guarantees, high performance and low latency ✅ Cross-chain Support: One set of code, multi-chain deployment ✅ Efficiency Improvement: Improve payment efficiency by 98% for users

💡 Core Value Proposition

✅ Current Deliverable Value

| Technical Capability | Performance Metrics | Business Value |

|---|---|---|

| Real-time Payment System | <1s Solana, <3s EVM | Instant settlement, frictionless transactions |

| Payment Efficiency Improvement | 98% efficiency improvement | Significantly enhance user experience |

| Agent Identity Verification | ERC-8004 standard | Verifiable trust, anti-counterfeiting |

| Developer Tools | TypeScript SDK | Quick integration, lower barriers |

🚀 Future Expansion Value

| Innovative Technology | Timeline | Strategic Significance |

|---|---|---|

| Patent Fifth-generation Wallet | Q3 2026 | Financial-grade security, future protection |

| Bank Smart Card Integration | 2027+ | Web2-Web3 unified experience |

| Agent Economic Ecosystem | Q3 2026 | Autonomous economic system |

🎯 Three Innovative Cornerstones

- 🏆 Patent Fifth-generation Digital Wallet: Open-source wallet technology adopting post-quantum cryptography (PQC) security standards, providing bank-level quantum computing threat protection

- 🏦 Bank Smart Card Integration: Dual-chip smart card technology enabling seamless fusion of Web2 bank accounts and Web3 wallets, connecting traditional finance and decentralized finance

- 🔒 Bank-grade Security: Financial institution-level security standards and compliance, ensuring the highest trust and protection for financial transactions

2. Collaboration Framework: Ecosystem Development Strategy

🌐 Four Major Collaboration Ecosystems

Collaboration Value: Four ecosystems empower each other, jointly building a complete AI Agent economic system.

🎯 Collaboration Value Positioning

| Partner Type | Core Demands | FinAI Solutions | Expected Benefits |

|---|---|---|---|

| AI Agent | Monetization capability | Payment + Identity + Reputation | Income growth 200%+ |

| Web2 Enterprises | Digital transformation | Web3 fusion | User retention improvement 30% |

| Web3 Service Providers | User growth | Agent economic access | Active user doubling |

| Blockchain Projects | Ecosystem expansion | Native AI support | Developer quantity doubling |

📊 Collaboration Assessment Standards

We evaluate collaboration opportunities based on three dimensions:

- Technical Compatibility: Ease of integration between existing systems and FinAI

- Business Value: Contribution to the partner's business objectives

- Resource Investment: Development cycle and costs required for collaboration

Collaboration Mode Determination:

- Deep Collaboration: High technical compatibility + Significant business value → Customized development

- Standard Integration: Medium technical compatibility → Quick access

- Light Collaboration: Low technical compatibility → Keep monitoring, wait for maturity

Technical Architecture

FinAI Network adopts a three-layer architecture:

- Payment Layer (x402 Layer): HTTP 402 + Blockchain implementation for real-time payments

- Identity Layer (ERC-8004 Layer): Verifiable on-chain AI Agent identity (KYA - Know Your Agent)

- Reputation Layer (Trust Layer): Immutable reputation scoring system

Supported Networks

- Production Ready: Solana (<1s), BSC (<3s), Base (<3s), Polygon (<3s), Arbitrum (<3s), Optimism (<3s)

- Identity Registration: Ethereum (ERC-8004 Registry)

- Scalability: Supports any EVM-compatible chain, FinAI North America technical team provides rapid integration services

3. Web2 Enterprise Payment Settlement Expansion Collaboration

🎯 Scenario Overview

Expansion of Web2 Enterprise Payment Settlement Capabilities

- Traditional bank digital transformation to obtain blockchain payment settlement capabilities

- Cross-border e-commerce payment process optimization, reducing costs and improving efficiency

- Large model payment mode innovation, supporting flexible AI service payments

- AI Agent usage payment modes, establishing new payment economic systems

Web2 enterprises face opportunities and challenges in digital transformation, needing to obtain blockchain payment capabilities to expand business scenarios. FinAI Network provides secure, controllable Web3 transformation paths to help enterprises seamlessly access blockchain economies.

🎨 Collaboration Vision

Create "New Digital Infrastructure" to transform traditional Web2 enterprises into comprehensive service platforms supporting both Web2 and Web3 simultaneously. Through FinAI, enterprises can seamlessly obtain blockchain payment capabilities and expand their commercial scenarios and user services.

🏗️ Fusion Value Positioning

FinAI helps Web2 enterprises build a comprehensive fusion service framework of "Traditional Business + Web3 + AI":

- Traditional Business: Maintain existing business models and user experiences

- Web3 Capabilities: Seamlessly access blockchain payments and digital assets, obtaining on-chain settlement capabilities

- AI Enhancement: Provide intelligent services and automated processes, able to call AI Agent capabilities

💡 Web2 Enterprise Transformation Value Matrix

✅ Five Core Values Web2 Enterprises Obtain Through FinAI

| Capability Module | Technical Implementation | Values Obtained by Web2 Enterprises |

|---|---|---|

| Blockchain Payment Capability | x402 protocol integration | Obtain on-chain payment capabilities, expand settlement convenience |

| AI Agent Usage Access Capability | RESTful API | Banks can conveniently use various AI Agent services |

| AI Agent Economic Access | Standardized protocols | Help banks establish economic bridges with AI Agents |

| On-chain Reputation Mechanism | ERC-8004 identity system | Cryptographic reputation mechanisms guarantee trust establishment |

| Bank-grade Security | Compliance security standards | Financial institution-level security protection, ensuring highest trust levels |

🚀 Future Innovative Products

| Innovative Products | Launch Time | Market Impact |

|---|---|---|

| Smart Bank Card | 2027+ | Redefine payment experience |

| Unified Identity System | Q3 2026 | Financial identity revolution |

| AI Financial Assistant | Q2 2026 | Intelligent financial services |

🔍 Core Problems Solved

Five Major Mountains in Web2 Enterprise Digital Transformation

- 💰 High Payment Costs: Traditional payment methods have high fees, low cross-border settlement efficiency

- 🚀 Limited Business Innovation: Difficulty in quickly accessing AI services and new payment modes

- 🔐 Missing Trust Mechanisms: Lack verifiable identities and reputation systems

- ⚖️ Compliance Transformation Pressure: Challenges in integrating Web3 technology with existing business regulatory frameworks

- 🔄 Technology Access Risks: How to securely obtain blockchain capabilities and AI services without affecting existing businesses

📋 Collaboration Mode Details

Collaboration Mode Overview

We provide three flexible optional cooperation methods based on collaboration depth and objectives. Deployment pace and delivery milestones will be customized according to project scale and business priorities:

- Gradual Access: Suitable for enterprises hoping for low-risk pilots of blockchain or Agent capabilities. Progress in stages, pilot first and expand after verification. FinAI provides quick access toolkits and technical assistance to lower trial barriers.

- Deep Integration: Suitable for enterprises with technical foundations hoping for complete integration into Agent ecosystems. We provide end-to-end integration capabilities, jointly formulate technical solutions with customers and ensure enterprise-level delivery quality.

- Ecosystem Co-construction: Suitable for strategic partners willing to co-build industry standards and long-term collaboration. FinAI can establish joint governance and joint R&D paths with partners, promoting industry-level implementation.

Regardless of the chosen mode, FinAI North America technical team possesses global cooperation rapid deployment capabilities, providing 24-hour instant support and continuous service guarantees. Deployment details and timelines will be discussed confidentially with customers and formulated on-demand to ensure optimal alignment of business and technology.

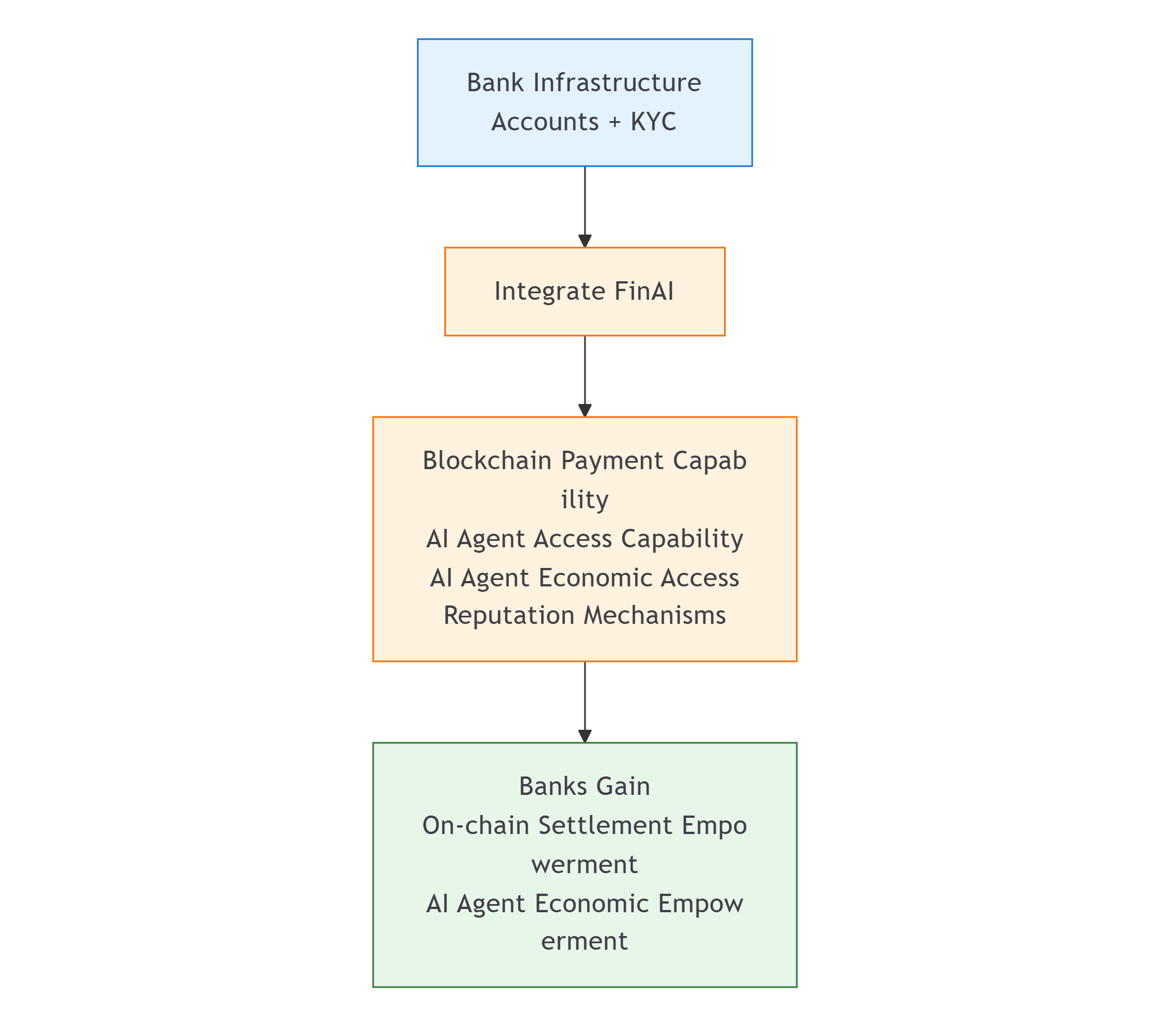

📋 Demo Example One: Traditional Bank Digital Transformation

Business Scenario Comparison

Traditional Bank Services (Capability Gaps):

Enterprise customers need AI services → Find AI suppliers separately → Tedious contract and payment processes

Cross-border trade payments → SWIFT system, expensive and slow

Digital asset management → Need external custody services, complex compliance

❌ Service fragmentation ❌ Low efficiency ❌ High costs

FinAI Collaboration Bank (Five Parallel Capabilities):

Banks obtain five parallel foundational capabilities:

Blockchain payment capability → Obtain on-chain payments for various settlements

AI Agent usage access capability → Banks can conveniently use AI Agent services

AI Agent economic access → Establish economic bridges and cooperation with AI Agents

Reputation mechanism → Reputation mechanisms guarantee trust relationship maintenance

Bank-grade security → Financial institution-level security standards, ensuring highest trust levels

✅ Comprehensive capabilities ✅ Ecosystem win-win ✅ Value enhancement

🏛️ Collaboration Capability Integration Chart

Collaboration Example: Commercial Bank + FinAI Enterprise Services

Collaboration Process:

- Bank Provides → Digital wallets and account systems for enterprise customers

- FinAI Provides → On-chain payment capabilities and AI Agent infrastructure

- Service Integration → Integrate FinAI payment capabilities in bank digital wallets

- Capability Launch → Enterprise customers can call AI Agent services through bank channels

Specific Implementation:

- Bank obtains blockchain payment capabilities, expands settlement convenience

- Bank can conveniently access and use AI Agent capabilities

- Help banks establish economic bridges and cooperation with AI Agents

- Reputation mechanisms guarantee trust relationship maintenance

- Both parties share revenue based on service usage

Collaboration Value Analysis

| Dimension | Traditional Web2 Enterprises | FinAI Collaboration Enterprises | Competitive Advantage |

|---|---|---|---|

| Blockchain Payments | Traditional settlements | Obtain on-chain payment capabilities | Settlement Expansion |

| AI Agent Usage | No AI capabilities | Can conveniently use AI Agents | Service Innovation |

| AI Agent Economy | Ecosystem isolation | Establish economic bridges | Ecosystem Access |

| Reputation Guarantee | Traditional trust | On-chain reputation mechanism guarantees | Trust Upgrade |

Commercial Revenue Expectations

- User Retention: Prevent 20-30% loss of young users

- Revenue Growth: Obtain new revenue sources through Web3 and AI services

- Brand Upgrade: Become a benchmark for financial technology innovation

- Compliance Leadership: Embrace innovation within regulatory frameworks safely

- Future Potential: Bank smart card integration: Enable seamless fusion of Web2 bank accounts and Web3 wallets, connecting traditional finance and decentralized finance

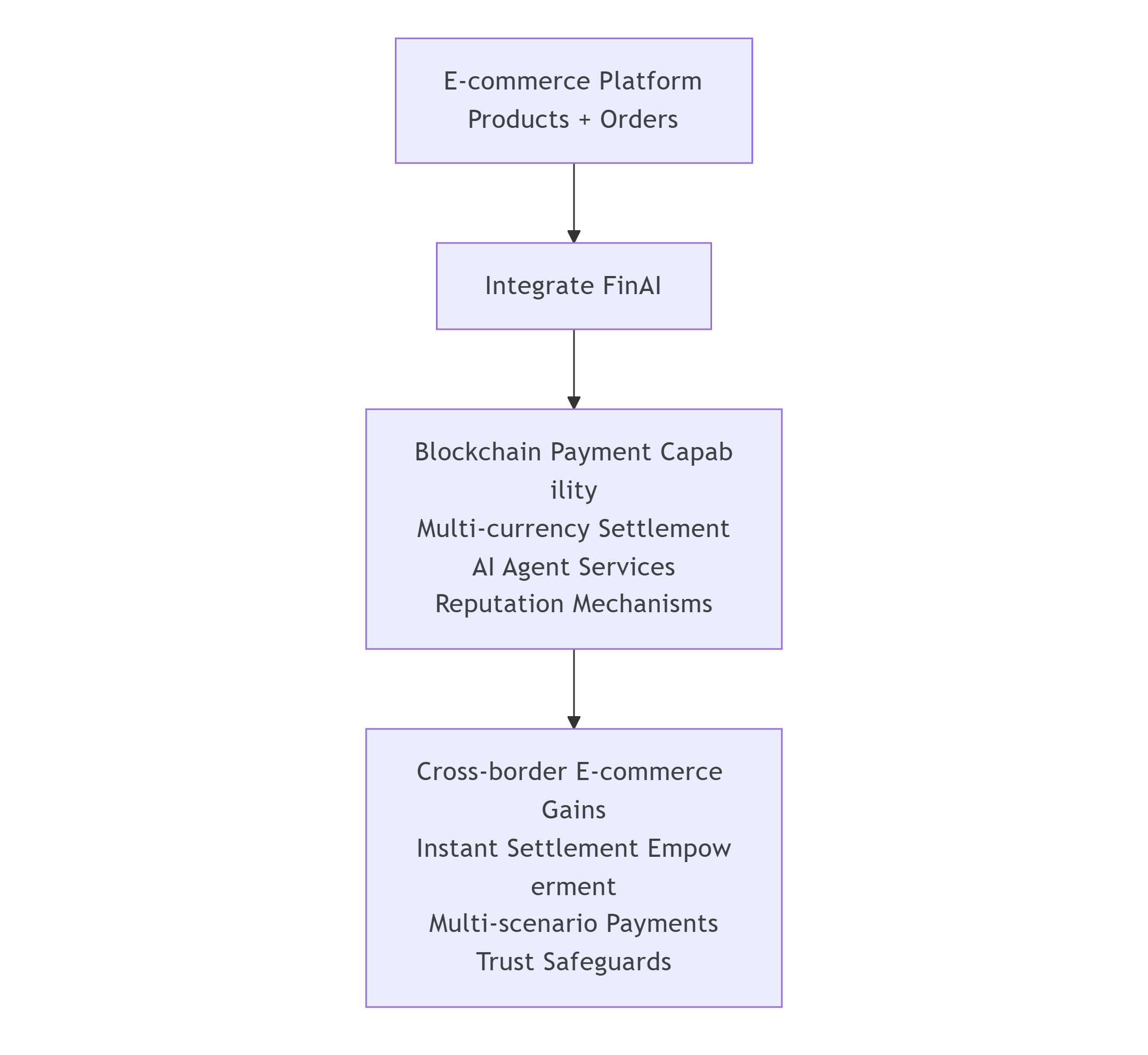

📋 Demo Example Two: Cross-border E-commerce Payment Settlement Optimization

Business Scenario Comparison

Traditional Cross-border E-commerce Payments (Pain Points Abound):

Buyer places order → Selects payment method → Jumps to third-party payment → Currency conversion → Cross-border fees → Seller delayed receipt

⏱️ Total time: 3-7 days 💰 Cost: 3-8% fees 🤝 Trust: Dependent on intermediaries

FinAI Collaboration E-commerce Platform (Efficiency Improvement):

Buyer places order → Blockchain instant payment → Automatic exchange settlement → Instant receipt → Smart contract execution

⏱️ Total time: <3 seconds 💰 Cost: 0.1-0.3% fees 🤝 Trust: On-chain verifiable

🌐 Cross-border E-commerce Capability Integration Chart

Collaboration Example: Cross-border E-commerce Platform + FinAI Global Payments

Collaboration Process:

- E-commerce Platform Provides → Product display and order management systems

- FinAI Provides → Global blockchain payment networks and AI settlement services

- Technical Integration → Embed FinAI payment gateways in e-commerce platforms

- Business Launch → Support multi-currency instant settlements and AI customer service

Specific Implementation:

- E-commerce platforms obtain blockchain payment capabilities, support global instant settlements

- Cross-border buyers can pay in local currencies, automatic exchange conversion

- Integrate AI Agents to provide intelligent customer service and personalized recommendations

- Reputation mechanisms guarantee buyer-seller transaction security

- Both parties share revenue based on transaction amounts and service fees

Collaboration Value Analysis

| Dimension | Traditional Cross-border E-commerce | FinAI Collaboration E-commerce | Competitive Advantage |

|---|---|---|---|

| Payment Efficiency | 3-7 day settlement | Instant receipt | 95% Efficiency Improvement |

| Fee Costs | 3-8% | 0.1-0.3% | 90% Cost Reduction |

| User Experience | Multi-platform jumps | One-stop payment | Experience Optimization |

| Trust Mechanism | Platform guarantee | On-chain reputation | Trust Upgrade |

Commercial Revenue Expectations

- Conversion Rate Improvement: Simplify payment processes, increase 30-50% order conversion

- Cost Savings: Payment processing fee reduction significantly improves profits

- Market Expansion: Support more countries and currencies, expand global markets

- User Growth: Improve payment experience, attract more international buyers

- Innovation Advantage: Become a leading platform for cross-border e-commerce payment innovation

4. Collaboration Process and Contact Information

Collaboration Process

- Initial Contact: Send collaboration proposal to [email protected]

- Demand Assessment: We will assess your specific needs and collaboration opportunities

- Technical Docking: Arrange technical teams for in-depth discussions

- Solution Formulation: Jointly formulate detailed collaboration solutions and technical roadmaps

- Pilot Testing: Conduct integration and function verification in test environments

- Formal Collaboration: Sign collaboration agreements, begin comprehensive collaboration

Contact Information

- Official Website: finai.network

Partner Benefits

- 🔧 Technical Support: Dedicated technical team support

- 📚 Document Access: Complete technical documentation and APIs

- 🎯 Joint Marketing: Collaboration promotion resources

- 💰 Revenue Sharing: Reasonable transaction fee allocation

- 🏆 Priority Support: Priority access to new features

- 🤝 Ecosystem Co-construction: Joint standard formulation and governance

5. Implementation Path: From Collaboration to Launch

🎯 Project Implementation Overview

FinAI adopts a phased customized delivery process: Preparation → Integration → Verification → Launch → Continuous Optimization.

Delivery pace and milestones are customized based on collaboration depth and business priorities.

📋 Implementation Phase Details

- 🔍 Preparation & Alignment: Clarify business objectives, compliance boundaries, and delivery standards, determine collaboration scope and key results

- ⚙️ Integration & Development: Complete API/SDK integration and necessary customized development on-demand, ensuring engineering delivery quality

- ✅ Verification & Acceptance: Conduct function, security, and performance verification, jointly confirm delivery standards with customers

- 🚀 Launch & Monitoring: Adopt phased launch strategies and continuously monitor core business indicators and stability

- 📈 Continuous Optimization: Continuously iterate based on operational data and business feedback, ensuring long-term value delivery

🛡️ Technical Safeguards

FinAI North America technical team provides global vision and first-tier standards:

- ⚡ Rapid Deployment: Quick response to customer demands

- 🕒 24-hour Response: Full-time technical support

- 🤝 Full-process Accompaniment: Complete service from docking to launch

Ensure every partner can efficiently and securely achieve business landing and continuous optimization.

6. Business Collaboration: Contact and Support

📞 Contact Information

Business Collaboration

- Email: [email protected]

Technical Support

- Developer Portal: https://github.com/FinAipay/FinAi

Media Inquiries

- Official Website: finai.network

🎯 Collaboration Application Process

Complete Collaboration Application Process:

- Intent Expression → Send collaboration email

- Initial Communication → We will arrange phone calls or online meetings as soon as possible to further understand needs

- Demand Research → Detailed analysis of business and technical needs

- Solution Formulation → Customized exclusive collaboration solutions

- Business Negotiation → Discuss contract terms and benefits

- Agreement Signing → Formally sign collaboration agreements

- Implementation Initiation → Project begins execution and landing

Key Safeguards:

- Rapid response: We will arrange communication and allocate appropriate resources upon receiving intent

- Professional assessment: Technical + business dual-dimension analysis

- Compliance assurance: Legal frameworks protect rights of both parties

🌟 Partner Benefits

🥉 Standard Partners

- ✅ Basic technical support

- ✅ Standard SDK access

- ✅ Community resource sharing

- ✅ Joint marketing opportunities

🥈 Advanced Partners

- ✅ All standard benefits

- ✅ Dedicated technical support

- ✅ Customized development

- ✅ Priority feature access

- ✅ Joint press conferences

🥇 Strategic Partners

- ✅ All advanced benefits

- ✅ Joint R&D projects

- ✅ Brand joint exposure

- ✅ Ecosystem fund support

- ✅ Board-level communication

📈 Successful Collaboration Cases

AI Agent Field

- Content Generation Platform: 300% monthly revenue growth after integration

- Automation Tools: 5x user conversion rate

- Intelligent Assistants: 3x market share expansion

Financial Field

- Digital Banks: 35% user retention rate improvement

- Payment Institutions: 80% cross-border payment cost reduction

- Investment Platforms: 200% new user acquisition growth

Web3 Field

- Wallet Applications: Daily active users doubled

- DeFi Protocols: TVL growth 150%

- Trading Platforms: 80% trading volume increase

🎉 Ready to Take Action

Ready to build the future of AI Agent economies together!

- 📧 Send Email: [email protected]

- 🌐 Visit Official Website: finai.network

FinAI Network looks forward to collaborating with you to create brilliance!

FinAI Network © 2025. Building trust infrastructure for the machine economy.

Looking forward to collaborating with you to create a beautiful future for AI Agent economies!